put call ratio today

Put-Call ratio for INDUSINDBK. The equity putcall ratio on this particular day was 064 the index options putcall ratio was 119 and the total options putcall ratio was 072.

|

| Put Call Ratio Above The Green Line |

Our trusted markets are some of the largest and most reliable in the world.

. How to Interpret the Put-Call Ratio 1. Intraday Put OI 0. 1 As you will see below we need. So the put call ratio formula for the former method is.

We operate equities options futures and FX markets across North. A rising put-call ratio or a ratio greater than 07 or exceeding 1 means that equity traders are buying more puts than calls. Put call ratio put call ratio. 196 rows Put-Call ratio for NIFTY Last Updated on 25 Nov 2022 0345 PM IST 01DEC2022.

Intraday Call OI 0. The ratio is calculated by dividing the number of traded put options by the number of traded call options. View live and historical Put Call Ratio chart for nifty and banknifty options. The put call ratio chart shows the ratio of open interest or volume on put options versus call options.

Explore Our Markets. 26 rows SPX PutCall Ratio 149 for Nov 23 2022 Overview Interactive Chart. The put call ratio shows overall sentiment mood of the market. An extremely rare signal flashed in the stock market on Tuesday suggesting big gains ahead.

Interpreting the Number A PCR below one. Last Updated on 25 Nov 2022 0421 PM IST 29-Dec-2022 26-Jan-2023 Call OI 0. PCR itself is a. The ratio reflects the volume of put options and call options.

Also available are pre-built subindicators that are created by. The PCRE PCRI PCRT and PCRVIX. PCR Total put open interest Total call open interest. PCR OI Total.

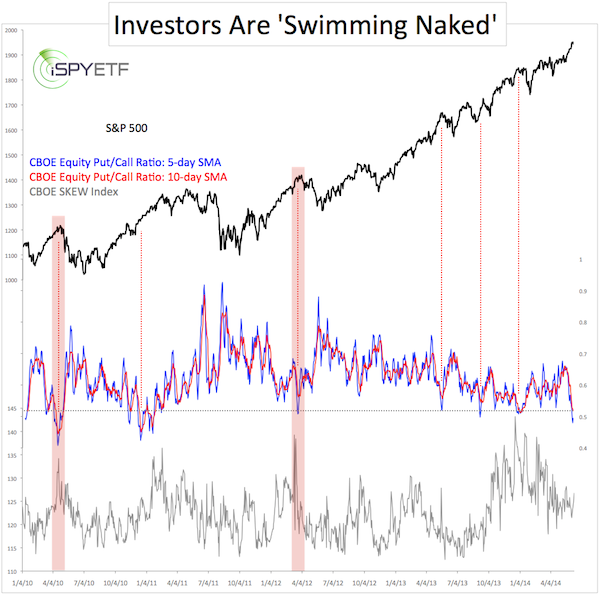

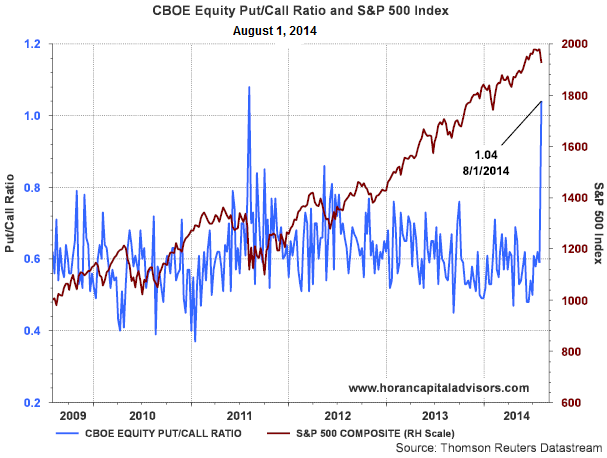

Thats according to Fundstrats Tom Lee who highlighted a surge in the put-to. It suggests that bearish sentiment is building in the. Put-Call Ratio Last 8 Week Chart by author The move was sudden and very sharp up 35 above the average for the last 8 weeks and 50 above the long-term average. If the PCR Put Call Ratio is increasing during correction in the up trending market this is very bullish indication.

What is the Put Call Ratio. The total open interest of calls for the expiration date. The put-call ratio for the security is 1250 1700 07353. 26 rows CBOE Equity PutCall Ratio is at a current level of 063 NA from the previous market day and up from 040 one year ago.

The put to call ratio PCR is a mathematical indicator that investors use to determine market sentiment. Put Call Ratio is generally viewed to know the trader sentiments in the options market. November 17 2022 906 PM UTC. As already stated the put call ratio calculator involves two methods open interest OI and trading volume VOL.

PutCall ratio PCR is a popular derivative indicator specifically designed to help traders gauge the overall sentiment mood of the market. What is the Put-Call Ratio The put-call ratio is an indicator ratio that provides information about relative trading volumes of an underlying securitys put options to its call. It means the Put writers are aggressively writing at dips. PutCall Ratios.

Cboe put-call ratio for single stocks reaches a 25-year high. This is a change of NA from the previous. The total open interest of puts for the expiration date. The put call ratio can be an indicator of investor sentiment for a stock index or the.

PutCall Open Interest Ratio. Since the outcome is less than 1 it indicates that investors are buying more call.

|

| Equity Put Call Ratio At 41 Month Low But Risk Of Black Swan Event Limited |

|

| What Is Put Call Ratio In Options Trading How To Interpret It |

|

| Equity Put Call Ratio Spikes To Above 1 0 Investing Com |

|

| Long Term Weighted Put Call Ratio Chart Option Strategist |

:max_bytes(150000):strip_icc()/dotdash_Final_Forecasting_Market_Direction_With_Put-Call_Ratios_Nov_2020-01-4e7625ce7f2945f98ae81546e6611823.jpg) |

| Forecasting Market Direction With Put Call Ratios |

Post a Comment for "put call ratio today"